Highfield Resources Limited (ASX:HFR) has received a significant boost in its transformational deal with Yankuang Energy Group Co., Ltd.

The Australian Foreign Investment Review Board (FIRB) has issued a statement of no objection to Yankuang Energy’s proposed subscription of up to US$376 million in Highfield shares, priced at $0.50 per share.

This FIRB approval satisfies a key condition for Highfield’s ambitious transaction with Yankuang Energy, which encompasses two major components.

First, a US$220 million equity capital raise involving Yankuang Energy and other strategic investors.

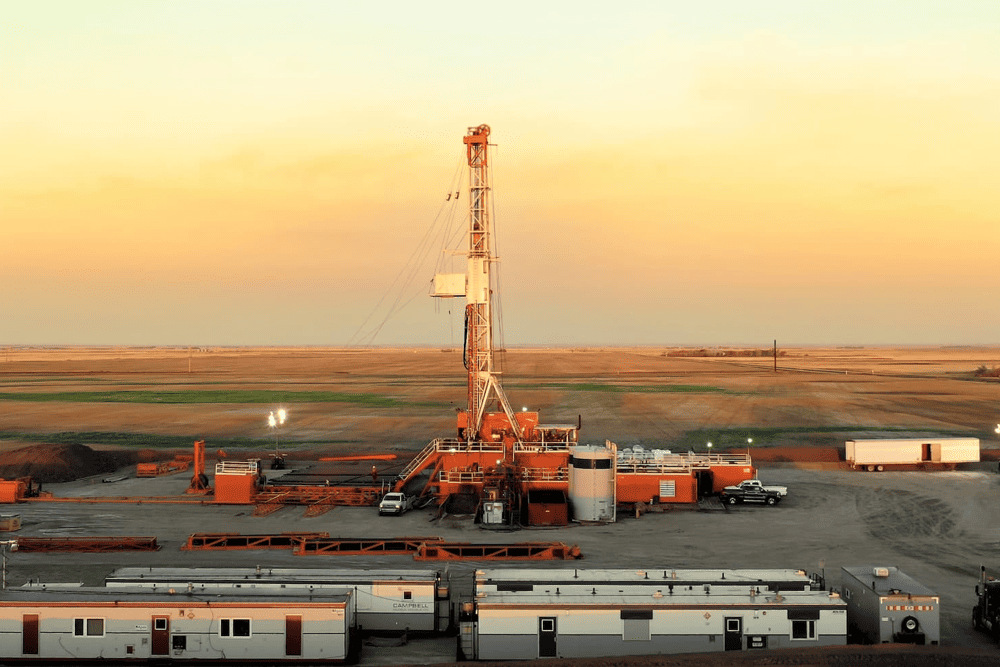

Second, the acquisition of the Southey Potash Project in Saskatchewan, Canada, from Yancoal Canada, a subsidiary of Yankuang Energy, valued at US$286 million.

Ignacio Salazar, CEO and Managing Director of Highfield Resources, expressed his satisfaction with the development, stating: “This positive result from FIRB is another major step in getting the deal to completion. FIRB’s timely approval is the result of presenting a solid application.

“The company is making significant progress with regards to the other jurisdictional approvals for the transaction.”

The transaction, expected to close in early 2025, will position Highfield as a globally diversified potash company.

It will fully fund Phase 1 of the company’s flagship Muga project in Spain, a construction-ready potash mine.

The addition of the Southey project in Canada will also expand Highfield’s portfolio.

This deal represents a significant milestone for Highfield Resources, potentially transforming it into a leading global potash player with assets in two tier-1 jurisdictions.

The company is now poised to play a crucial role in supplying critical agricultural markets and supporting global food security while aiming to deliver strong value to its shareholders.