It’s possible that a domestically-listed gold explorer, which boasts a not-too-shabby evolving flagship project in Western Australia’s Wheatbelt, may be looking to lithium to help boost its languishing market valuation.

No doubt the WA-based junior is also hoping that a farm-in agreement it made back in 2022 with a fellow exploration house will garner some much-needed shareholder interest sometime in the future.

When Austgold Ltd (ASX: AUC) presented at Vertical Events’ RIU Explorers Conference in February last year, its share price was around the 0.05 cents mark, giving it a market capitalisation of $105 million.

By the same time this year (mid-February), however, the stock had fallen to around 0.028 cents per share, diminishing its value by $45 million to $60 million.

Why this has happened is anyone’s guess, particularly at a time when gold is one of the better performing metals.

Moreover, there is no denying that the company kicked a few goals during the past 18 months as it went about de-risking its evolving Katanning Gold Project (KPG) and broadening its scale.

From an investment point-of-view this could all be something of a surprise given the calibre of the KPG, which sits some 40 kilometres north east of the farming township of Katanning (population circa 4000) and 275km south east from the WA capital of Perth.

It currently boasts a formidable resource of 3.04 million ounces at 1.06 grams per tonne, a maiden reserve of 1.26Moz at 1.25g/t, a 9.7 year life-of-mine with an initial six year annual production target of 155,000oz, as well as an early payback period of 20 months at a post-tax internal rate of return of 46 per cent.

So far a capital cost of $297 million has been pencilled in for the project, along with an annual yellow metal production of 136,000oz per annum, metallurgical recoveries of 90 per cent, an all-in sustaining operating cost of $1549oz over the current mine’s life as well as an operating margin of 56 per cent.

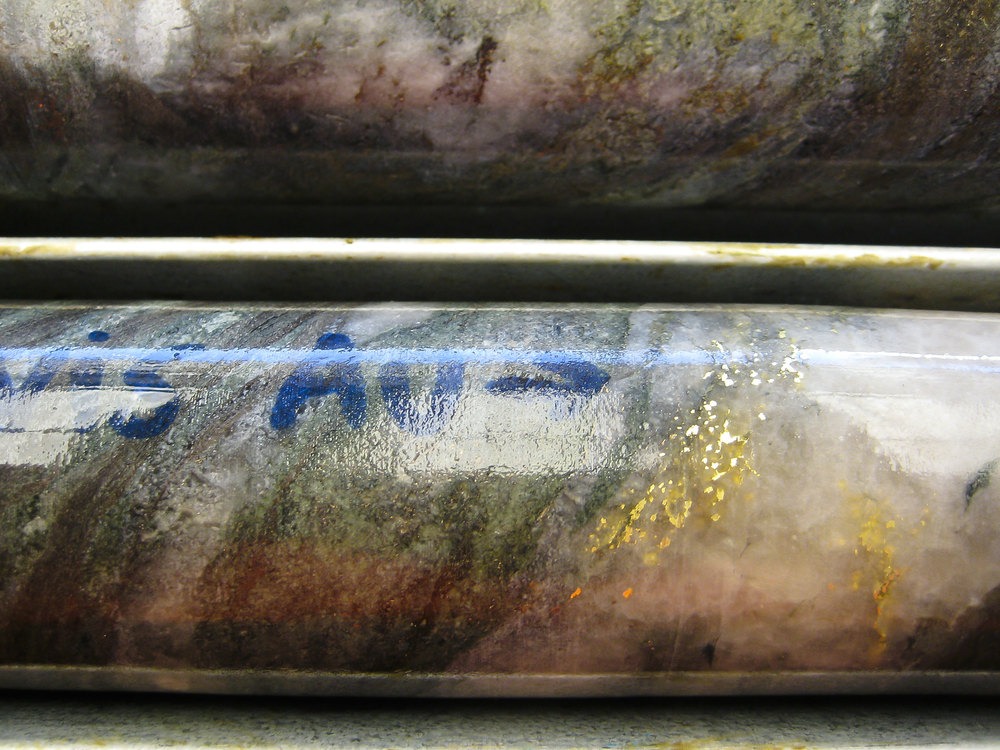

Furthermore, the KPG project contains plenty of upside given it has 5,500 km² of under-explored greenstone real estate in the south west Yilgarn Craton covering a 130km strike. Certainly some recent high grade drilling results attest to this.

These include healthy gold assays at the Dateline prospect of 3.3 metres at 11.47g/t from 218.9m, (including 0.3m at 99.3g/t and 0.3m at 13.2g/t), 7.4m at 4.54g/t from 231.6m (with 6m at 5.51g/t) as well as 2.7m at 10.73g/t from 180.2m (with part of this incept revealing 0.4m at 63g/t).

During the RIU show, Ausgold’s managing director Dr Matthew Greentree indicated the junior saw other gold opportunities at its 85 per cent-owned Stanley project and the self-generated Duggan prospect.

In terms of the former, which covers 233 km² and currently has a 24km strike length, the company acquired it in 2002 via a farm-in with what is now Cygnet Metals Ltd (which has since turned its attention to a lithium project in Quebec, Canada).

Here, past gold intercepts include 8.5m at 33g/t from 37.7m (including 2.4m at 114.62g/t), 8.6m at 19.27g/t from 24.7m (with 5.7m at 28.60 g/t), 7m at 12.56g/t from 21m, 16m at 4.99g/t from 30m), 9m at 6.87g/t, 27m at 2.26g/t from 21m, 15m at 3.96g/t from 24m and 9m at 5.01 g/t from 22m.

Meanwhile at Duggan, the rig has recently returned near-surface, high grade yellow metal mineralisation with assays comprising 4m at 9.30g/t from 84m, 1m at 43.20g/t from 52m (a new lode), 5m at 1.15g/t from 10m, 7m at 4.05g/t from 19m (including 5m at 5.50 g/t from 19m) as well as 4m at 5.48g/t from 72m (with 3m at 7.17g/t from 72m).

In terms of lithium, Ausgold has identified lithium cesium pegmatites via mapping and sampling on its western tenements just 40 km south east from the mighty Greenbushes mine, which is the world’s largest hard rock producer of the green metal.

A targeting program completed in conjunction with industry consultant RSC has already identified 11 prospective areas using machine learning techniques and integrating them with a geochemical database of over 122,000 surface samples, information regarding major structures and greenstones, 600 new stream sediment samples across the tenure as well as geophysics and remote sensing data.

Numerous pegmatite dykes, Dr Greentree noted, were identified in historic gold-only focused exploration. He also suggested the presence of rare earths in the greenstones.

Drilling is now anticipated to take place during the first quarter of 2024.

As for the company’s current low share price, Dr Greentree didn’t have much to say except given its resource base, the junior was “trading well under enterprise value”.

“If you want to look at a gold stock today, and I think gold is a commodity that people want to look at in 2024, I think Katanning and Ausgold is an absolute buy,” he told his RIU audience.

Dr Greentree makes a valid point, but it is quite possible that some investors are sceptical as they ponder the junior’s ability to raise the capital needed to build a full mine processing circuit once the definitive feasibility study comes out. As it stands the company expects to start this phase of due diligence in the second half of 2024 – which perhaps is an indication of just how advanced this project now is.

As pointed out by WA broking house Argonaut a little while back, at this stage of the game the only viable option for Austgold is to build a standalone processing operation given there are no other gold mines in the vicinity (with the possible exception of Newmont Mining Corporation’s Boddington, but one can’t see the world’s biggest gold miner getting involved with a fledgling under the current circumstances) that could toll treat its ore.

With the risk of capex creep in the current inflationary cost environment, raising the $297 million needed to build a full circuit may be hit by capex creep and perhaps involve the dilution of any upside the junior’s share price may gain as it marches towards its DFS.

For the time being at least, it’s undeniable this is a big ask for a company which currently has a share price under 1 cent.