Iron ore continues to be a significant part of Tasmania’s mineral landscape, with the state’s leading operation undergoing some expansion works to ensure it maintains its annual production of two million-plus tonnes of magnetite concentrate.

Meanwhile, a short-lived project to the south is ready to recommence mining once economic conditions improve.

Located 60 kilometres southwest of Burnie, Grange Resources Ltd’s (ASX:GRR) Savage River has been subjected to a definitive feasibility study (DFS) into underground extraction below the north pit and its integration with the company’s current open-cut operation. According to the miner this document has revealed some robust financial outcomes.

These results came, however, just as the miner experienced a slight drop in output – and an increase in costs – during the March quarter.

During this time concentrate production decreased, with 586,000t produced compared to 684,000t for the December reporting period due to the annual maintenance program.

Pellet sales also dropped (to 565,000t from 648,000t the previous three months), while average prices received fell to US$108.11/t compared to US$159.65/t by the end of last year.

In addition, unit cash operating costs rose to $161.70/t (from $132.59/t in the December quarter) thanks to lower concentrate production.

Furthermore, cash and liquid investments of $271.96 million and trade receivables of $30.37 million fell from $282.61 million and $57.73 million respectively.

Nevertheless, a dividend of $23.47 million was paid during the first three months of 2024 (as at the end of March the company had 11,000 shareholders, who received two cents per share for the reporting period), while an outlay of about $13.7 million was made on capital projects ‒ including pit stabilisation and decline work, a pellet plant crane, rail installation and a mine dewatering pump system.

Moreover, the cutback on the east wall of the north pit continued, with a focus on waste removal.

“Completion of the DFS on underground mining and the optimised integration with the current north pit open cut mine at Savage River support a new life-of-mine plan which will deliver substantial reductions in operating costs and carbon emissions, robust financial returns and the potential to further extend the mine life,” Grange Chief Executive Honglin Zhao said.

“The company is now proceeding with engineering planning work, finalisation of the development application and extension of the existing exploration decline.

“Final board and regulatory approval for construction is expected towards the end of 2024.

“The continuation of the exploration decline is progressing well, with over 500m of advance completed.

“All existing tenements, approvals and assets continue to be maintained in good order.”

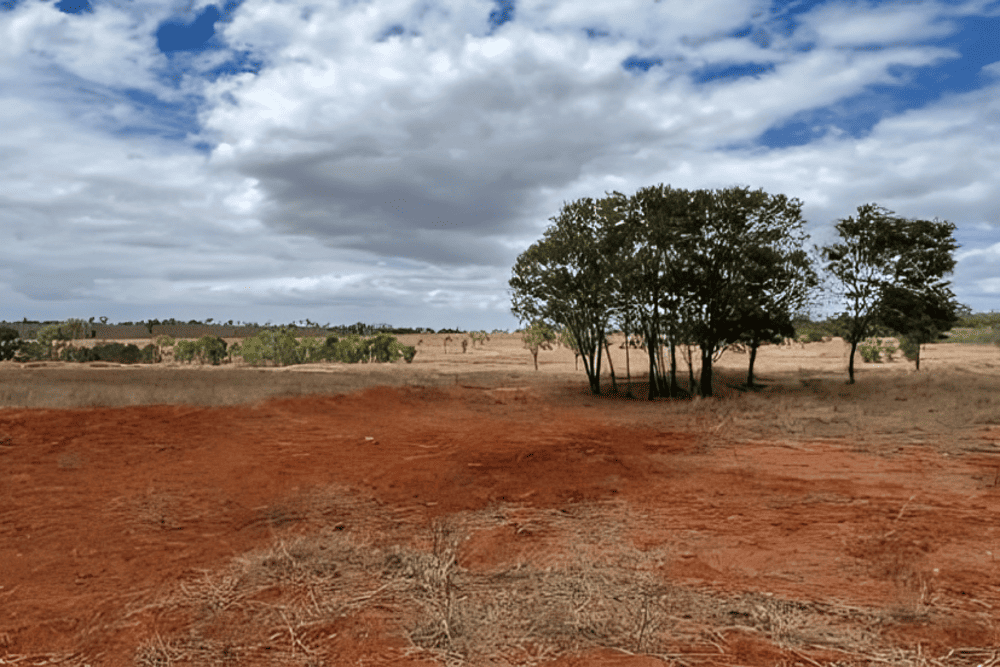

Meanwhile, some 20km to the southeast of Savage River is Venture Minerals Ltd’s (ASX:VMS) Riley direct shipping (DS) iron ore project, which is currently on care and maintenance after shutting down in September 2021 – the same year the mine was commissioned ‒ due to unfavourable market conditions.

With a reserve of 1.6 Mt at 57 per cent iron with low impurities, Riley is a relatively small deposit.

Its ore is a hematite-rich pisolitic and cemented laterite that is located at the surface (meaning there is no strip ratio), and it sits less than 2km away from a sealed road providing it direct access to the Burnie port.

As it stands the proposed life of the project is two years (at 800,000 tpa).

Riley’s maiden shipment averaged a grade of 57.3 per cent iron. The venture has since undertaken a full review of the operation to identify cost-efficiency measures.

All of the plant is still on hand, with infrastructure for the project consisting of a surface mine, a crushing and wet screening plant, stockpile areas, road network access, a downyard, a workshop area and offices.

As part of the restart plan, Venture has considered using dry screening in the circuit, conducted off-take discussions, determined storage solutions, finalised road access agreements, identified working capital requirements as well as pinpointed both the availability of trucks and shipping terms.

In addition, the Western Australian-based resources house owns the Livingstone DS hematite project, which is located around 20km northeast of Riley and consists of an outcropping hematite cap overlaying a magnetite-rich skarn.

Livingstone’s mineralisation occurs from the surface, is consistent in grade, and is situated only two kilometres from a sealed road, again giving it access to Burnie’s harbour facilities.

A resource statement of 2.2 Mt at 58 per cent iron was defined for the project in 2011, which was followed by what Venture said was a “positive and robust” scoping study.

Additional work later that year included blending and sizing test work as well as preliminary mining studies ‒ all of which delivered positive results. During the second half of 2012, the company completed a resource upgrade of the ore body to report an indicated resource of 2.4 Mt at 57 per cent iron. Despite this, Livingstone has remained on the junior’s backburner as it pursues other opportunities.

In an investment note on Venture conducted by East Coast Research’s Behzad Golmohammadi at the start of this year, it was suggested the iron ore market was set to rebound given population growth, rising living standards and the infrastructure required for decarbonisation were all expected to drive demand for steel and non-ferrous metals “for decades to come”.

“Chinese steel demand is a major factor impacting iron ore prices,” he said.

“However, the current slowdown in global economic growth has weakened the demand for steel (but) looking beyond the temporary economic down cycles, demand for iron ore is set to recover in the long term due to the infrastructure required to facilitate the transition to renewable and sustainable energy sources.”