In his 2023-24 budget, Prime Minister Anthony Albanese and the Australian government have stepped up support and funding intended to usher in a low-carbon, clean energy future while safeguarding Australia’s energy reliability and security. The budget also contains clean energy provisions intended to directly benefit the country’s mining industry as operators look to reduce carbon dioxide emissions efficiently and economically.

Budget funding directly impacting the mining sector includes funding for the established Critical Minerals International Partnerships Program to increase international engagement and attract foreign and domestic investment in strategic mining projects and additional support for the Critical Minerals Office and policies, programs and international engagement, in addition to other funding.

In May, the Albanese government also announced it intends to legislate a national Net Zero Authority to ensure the workers, industries and communities can capitalise on the opportunities of Australia’s net zero transformation. The initiative will include help for investors and companies who want to capitalise on net zero transformation opportunities in the energy, mining and other resources sectors.

While government funding and legislation alone will not ensure the country achieves its net zero greenhouse gas target and the private sector must step up with commitments to strategic investments in decarbonisation, too, it shows we are headed in the right direction.

Yet funding isn’t the only challenge for the mining sector because it also needs to identify and implement technological solutions that will make this goal a reality. Babcock & Wilcox (B&W) is a U.S.-based clean energy technology solutions provider with a strong, established presence in Australia. Our Asia-Pacific regional headquarters, based in Perth, has been working closely with energy, industrial and mining customers throughout Australia to identify opportunities and implement solutions for clean energy generation, hydrogen production, carbon capture and more.

For example, in October 2021, B&W announced an agreement with Port Anthony Renewables Limited to jointly develop a biomass-to-hydrogen clean energy project in Port Anthony, Victoria, Australia utilising B&W’s BrightLoopTM technology – an innovative chemical looping solution that can use virtually any fuel to produce hydrogen, steam or syngas and capture CO2 emissions for storage or beneficial use. The plant is expected to be part of the largest green hydrogen hub in southeastern Australia.

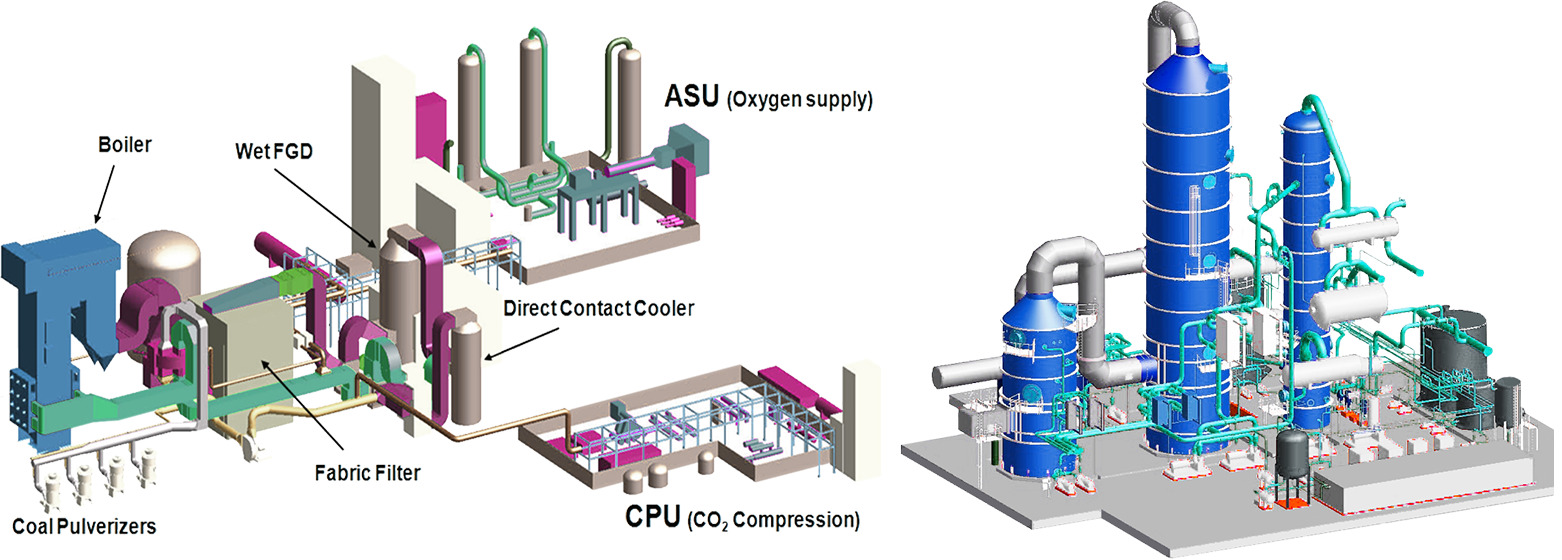

At left SolveBright at right OxyBright

BrightLoop is part of B&W’s ClimateBrightTM suite of commercial-ready decarbonisation and hydrogen technologies which we have developed through decades of research and testing. These solutions can be tailored to the rigorous and unique demands of the mining industry – whether iron, coal or rare earth minerals and other resource industries such as oil and gas and chemical production. B&W’s ClimateBright solutions include:

• BrightLoopTM – Developed by B&W and our university partner, this unique chemical looping technology can utilise virtually any fuel stock and effectively separates CO2 while producing hydrogen, steam and/or syngas for a variety of different applications.

• SolveBrightTM – Post-combustion CO2 capture technology that can utilise a variety of potential solvents.

• OxyBrightTM – Our oxy-combustion technology produces a concentrated CO2 stream suitable for sequestration and other uses and is applicable to a variety of fuel sources.

• BrightGen™ – Our hydrogen combustion technology is currently in operation in more than 60 water-tube boilers firing hydrogen or hydrogen-blended fuels.

B&W has commercial-ready technology and stands ready to work with government and the private sector to help Australia and the world achieve our climate and decarbonisation goals. With support and funding from the private and public sectors, we’re ready to help the mining industry meet their goals, using proven and effective solutions.

MINING INDUSTRY ON THE PATHWAY TO REDUCING EMISSIONS

According to a Minerals Council of Australia report, in 2020-21 the sector adopted and invested in new low emissions technologies that helped to reduce its Scope 1 emissions by 3.6 per cent.

Some of these include initiatives around hydrogen-fuelled freight, electric and autonomous vehicles, solar plants and battery storage, methane capture and conversion, CO2 emissions tracking systems, renewable energy agreements, battery minerals contracts and LNG-fuelled bulk carriers.

Whilst the emissions reduction is positive, it is a meagre figure compared to what will be required by the industry in coming years. According to a report by the Department of Climate Change, Energy, the Environment and Water, the uptake of cleaner energy and technology is projected to reduce emissions in the mining sector by around nine million tonnes from 2023 to 2030 and by 16 million tonnes from 2031 to 2035.

Energy emissions from coal production are projected to decline by two million tonnes, or 18 per cent from 2020 to 2030, mainly driven by lower coal production. Emissions are expected to decline further by one million tonne by 2035, largely due to the electrification of mining equipment. Emissions from iron ore and gold mining are projected to be relatively stable to 2030, but are projected to decline by 20 per cent until 2035, largely due to the switch from diesel mining equipment to electric. Electrification and displacing diesel are the key drivers to decarbonising mining, with investment and action projected to accelerate after 2030.

Mining operations are incentivised to switch to hybrid systems to reduce reliance on high-cost liquid fuels, currently generating more than 40 per cent of the industry’s energy. By 2035, one gigawatt of new renewable capacity is expected to be added by the industry, comprising mostly large-scale solar but also wind and small-scale solar.

CUTTING EMISSIONS FROM SITE TO MANUFACTURING

The sector’s direct and indirect emissions, also referred to Scope 1 and 2 emissions account for a smaller portion of emissions than Scope 3. The latter represent all other indirectemissions that the industry contributes, such as the production of fuels used in the mining operations, or the downstream smelting, refining, and manufacturing processes utilising the mined ore.

Using 2021 data, Sinai has calculated the proportion of Scope 3 emissions to total emissions for the top six global mining companies. The results showed that on average, Scope 3 emissions contribute to more than 95 per cent of total emissions. With these emissions being historically underreported, it is also the biggest decarbonisation challenge for mining companies. Nevertheless, new technologies are advancing to address this. One example is a new type of sinter developed by University of Queensland (UQ) researchers, in collaboration with Rio Tinto and Shougang Group, which could accelerate the iron and steelmaking sector’s carbon emissions reductions by cutting the coking coal content by more 20 per cent. Leader of UQ’s Sustainable Minerals Institute’s High Temperature Processing Program Dr Xiaodong Ma said it will enable industry to reduce emissions at both the sinter plant and the blast furnace.

“Sinter is an important part of the ironmaking process – it constitutes roughly 70 per cent of the charging material that is added to a blast furnace and therefore ultimately influences the industry’s emissions,” Dr Ma said.

“When you talk about carbon and emissions, you are really talking about two stages: the emissions created when the sinter itself is made and then the emissions created by the furnace in which the sinter is used.

“The sinter we have developed…addresses both stages but has a particularly significant effect on the amount of coke consumed at the sinter plant.

“It can reduce the amount of coking coal in the sinter by about 23 per cent – that is a huge amount considering the volumes of sinter used by the industry.

“Additionally, at the blast furnace stage it has improved reducibility and a low slag volume, meaning it performs better and therefore requires the blast furnaces to consume less coking coal.”

The project is one of many bringing together metal miners and metal makers, both of which have an interest in better understanding their product and reducing carbon emissions.

“Rio Tinto is the world’s second largest iron ore miner and their technical marketing team want to know how their iron ore fines are being used, and to what affect, as well as helping with the downstream carbon emissions related to them.”

By Alan Duke Clean Energy Development Director – Asia Pacific, Babcock & Wilcox