Net Zero is a growing global agenda that will require the mining industry to reduce direct greenhouse gas emissions (GHG) to zero, to limit global warming within 1.5°C by 2050.

Mining’s top leadership, therefore, need to prioritise their decarbonisation agendas to seriously consider their emissions impact and broader sustainability issues on their businesses. As a point of distinction from previous sustainability trends, those serious about holding companies to their Net Zero targets call for ‘less net, more zero’. This signals an appetite for more aggressive emission reductions as a primary approach, with emission offsets as only secondary to compensate for residuals.

However, instead of reducing mining to the background of the Net Zero transition, there is clear evidence that mining companies and their senior management need to be prepared to stand at the forefront of this shift if they are to benefit from the opportunities it presents.

Net Zero can mean different things to different people, and there are many different interpretations of this agenda. For instance, it is often confused with carbon neutrality; but becoming carbon neutral is only a waypoint on the road to Net Zero. Net Zero can also be framed as a goal to scale-up carbon offsets; but while carbon capture and storage will undoubtedly be needed, the principal objective is to phase down or abate emitting activities and technologies. Net Zero is a global goal against which various players are now setting their own targets, making commitments to gradually reduce their own share of global GHG emissions to zero, or near zero, by 2050.

There are four (4) clear opportunities for the mining industry in the transition to Net Zero.

1. The transition towards Net Zero depends on mining

The minerals mining needed to support a transition to a low carbon future is projected to skyrocket. The International Energy Agency (IEA) ‘s 2021 Net Zero report indicates that demand for critical minerals and various rare earth metals will increase ‘almost sevenfold between 2020 and 2030’, with production showing no signs of slowing down. Demand for steel and copper are also projected to grow in this decade. Lithium and rare earth elements are needed for rechargeable batteries, wind turbines and electric cars. Even green hydrogen cannot be green unless it is produced with renewable electricity.

However, while Australia is in a firm position to benefit from this substantial opportunity, this rapidly growing demand also causes concern given the finite nature of these resources. Mining executives will need to consider how they could meet demand responsibly and sustainably – balancing short-term demand responses with longer-term security of supply.

2. Scope 1 and 2 emissions are addressable in this decade

The good news is, addressing scope 1 and 2 emissions (i.e., direct emissions from mine operations) is achievable in this decade. The race to 2030 means that near-term targets can rely on existing interventions such as renewable energy, alternative fuels, electrification, and other efficiency improvements along the mining supply chain. Two global agendas coincide in 2030, which is widely viewed as an important checkpoint on the way to Net Zero. This is because the Intergovernmental Panel on Climate Change (IPCC) scenarios suggest that to have any chance of achieving the Net Zero marking the end of the ‘Decade of Action’ towards achieving the global Sustainable Development Goals (SDGs).

RPMGlobal has seen increased demand for decarbonisation advisory and software support in this space as clients are considering the available investment opportunities for their site-specific decarbonisation pathways. They require digital simulations to provide insight into options analyses for decarbonisation. In addition, using a digital twin mine for the purposes of forecast simulations allows for consideration of electrification and hydrogen fuel additions to current and forecasted fleet demands. Just as mining companies address their scope 1 and 2 emissions, the reduction of traditional mining employment opportunities signals the need to ensure the transition is just and equitable for all. The effects on communities directly affected by mining will need to be addressed, and it is critical that the transition is planned for today, with the future in mind.

3. Mining is in everybody’s scope 3

Australian mining companies are starting to understand their exposure to climate risks better. While the exposure from scope 1 and 2 emissions is better understood, inevitably, these companies will be called to account for their scope 3 emissions as well – that is, the climate impacts of their suppliers and customers. In 2020, EY identified license to operate as the biggest risk factor for mining and metals. The pressure to accelerate decarbonisation is also high on the list, and in addition to renewables and electrification, scope 3 is foremost among these risks. For instance, one global, tier one miner estimates their scope 3 emissions around 402.5 Mt CO2-e and their scope 1 and 2 to be around 16.2 Mt CO2-e. Therefore, scope 3 accounts for over 90% of their emissions – significantly higher than the direct emissions from sources like electricity and diesel use in their mines.

But the converse is also true: mining operations are in everybody’s scope 3. As upstream resource extractors and suppliers of capital goods, the globalised supply chains for many mainstream products, services and technologies begin in a mine. Without mining, our modern-day lives would look very different. Producers of digital technologies, for instance, will inevitably need to account for mining operations in their scope 3 emissions. From mobile phones to microwave ovens, almost everything we use today was made possible or impacted by mining – and these industries will all inevitably need to account for mining within their own scope 3 calculations.

From this perspective, Net Zero is not only a risk factor for mining – there are significant opportunities to be gained as well. Mining customers, and distributors of goods reliant on mining, should consider not only offsetting their emissions but also ‘insetting’ their emission abatement interventions.

While carbon offsets allow companies to compensate for their GHGs by implementing carbon storage projects outside of their value chains, ‘carbon insets’ is a more recently defined strategy where companies pay for their emissions by implementing carbon storage projects within their value chains.

When combined with nature-based solutions that use and enhance natural spaces, insetting can be an effective tool to generate positive emissions abatement outcomes and holistic ecological and community outcomes. When combined with technological solutions, insetting can facilitate cost- and insight-sharing among players in a value chain, leading to transition cost reductions for all involved.

Though it has not been described as an insetting project, another tier one miner has established a $10 million deal with a global steelmaker to support Research and Development, as well as implementation of low-carbon technologies in the sector is an example of insetting using technological solutions. The partnership is an example of the opportunities available to companies willing to engage with and within the mining industry to reduce scope 3 emissions collectively.

4. Mining has a place in a low-carbon future

What role will mining play in a low-carbon future, beyond 2030 and 2050? Some of the technologies and solutions already available today – and some of the challenges already being solved – provide some clues.

One of the challenges being addressed is standardising methods that establish Net Zero baselines and targets. For mining, the task is to translate the global carbon budget into a global minerals and metals budget that defines just how much will be ‘enough’ to meet the world’s residual demand for these capital goods now. After all, available efficiency and consumption reduction interventions must be applied in the future.

Just as access to investment, financing and insurance is increasingly dependent on mining companies’ commitment to sustainability issues, once Net Zero standards are adopted, mining CEOs will need to disclose activities based on these budgets too. Also, as these standards are adopted, they will increasingly be considered in mine design and approvals processes.

Finding the right balance between responding to immediate demands and ensuring longer-term security of supply, all within a global carbon and materials budget, will be challenging for miners.

To prepare to supply enough for this low-carbon future, mining companies can now adopt circular economy strategies involving resource recovery and reuse tactics. As they engage more widely along their supply chains to address scope 3 emissions, opportunities for product stewardship programs will become increasingly available for miners. This conversation is already happening regarding recycling rare earth minerals from products already circulating in the economy, such as batteries and smartphones. Other tactics include recycling and other forms of resource efficiency improvements in mining processing operations and energy efficiency improvements, and electrification.

Mining is part of the solution

Australia is poised to set an example for the rest of the world on sustainable mining. Considering the challenge posed by the projected increased demand for mining, there is a significant opportunity to practice responsible resource extraction – potentially with resource extractors at the helm, but a correspondingly substantial decline in consumption must support this shift.

The potential for a circular economy of mining, the integration of renewable energy technologies, fleet electrification, and an enhanced focus on the social implications of ensuring a just transition, all point to the need for a combined approach across all stages of the mining value chain. The solution requires the combined efforts of mining companies, their customers, and end-users’ efficiency and consumption reduction efforts. With all these factors in mind, mining is vital to the Net Zero transition.

Supporting Net Zero goals

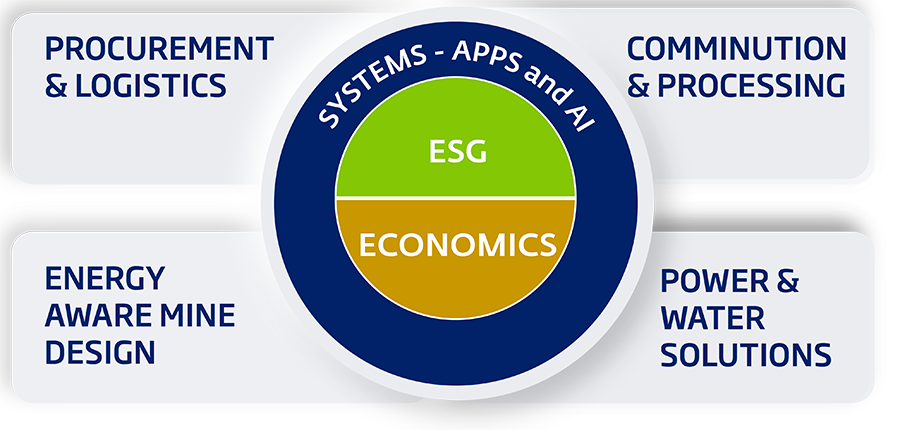

In line with the global industry, RPMGlobal has progressed to support operations in achieving their Net Zero goals. In the 2022 financial year alone, the company acquired two ESG consulting firms, increasing the in-house capability to assist the industry in developing ESG frameworks. These solutions offer Net Zero support throughout the entire life of mine, optimising decision making for long-term strategic goals. RPM has also introduced software solutions to plan and simulate activities for a more sustainable future, as well as technology for proactive capturing and reporting of emissions data. There are also numerous capabilities within existing software solutions to support the march towards Net Zero.

RPMGlobal’s expertise and capability across our services provide accurate and reliable insights into your operations emissions management. To achieve Net Zero, mining operations must trust their data and frameworks while maintaining agility within the current environment. RPMGlobal’s solutions provide innovative structures to manage your emissions, cultivate a more sustainable mine life cycle and report on Net Zero progress.

Cle-Anne Gabriel, Executive Consultant – RPM Decarbonisation Lead

Ngaire Tranter, General Manager – RPM ESG

References

Dowall, T., 2021. Science-Based Net-Zero Targets: ‘Less Net, more Zero’. Retrieved on February 23 from https://sciencebasedtargets.org/blog/science-based-net-zero-targets-less-net-more-zero

Mitchell, P., Downham, L. and van Dinter, A., 2020. Top 10 business risks and opportunities – 2020. Retrieved on February 23 from https://www.ey.com/en_au/mining-metals/10-business-risks-facing-mining-and-metals

Finch, M. and Finch, E., 2022. How Australia’s geology gave us an abundance of coal – and a wealth of greentech minerals to switch to. Retrieved on February 23 from https://theconversation.com/how-australias-geology-gave-us-an-abundance-of-coal-and-a-wealth-of-greentech-minerals-to-switch-to-173988?utm_source=linkedin&utm_medium=bylinelinkedinbutton

International Energy Agency (IEA), 2021. Net Zero by 2050: A Roadmap for the Global Energy Sector. Retrieved on February 23 from https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf

Intergovernmental Panel on Climate Change (IPCC), 2021. Summary for Policymakers. In: Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [MassonDelmotte, V., P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M.I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T.K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, and B. Zhou (eds.)]. Cambridge University Press. In Press.